All Categories

Featured

Table of Contents

- – Work Related Accident Lawyers Wilmington, CA

- – Visionary Law Group

- – Accidents At Work Claims Wilmington, CA

- – Attorneys For Workers Compensation Wilmington, CA

- – Attorney For Workers Comp Wilmington, CA

- – Work Injury Attorney Wilmington, CA

- – Workmens Comp Lawyer Wilmington, CA

- – Lawyer For Workmans Comp Wilmington, CA

- – Worker S Compensation Lawyers Wilmington, CA

- – Work Labor Lawyer Wilmington, CA

- – Visionary Law Group

Work Related Accident Lawyers Wilmington, CA

The United State Department of Labor's Office of Workers' Settlement Programs (OWCP) administers four significant impairment settlement programs which supplies to government workers (or their dependents) and other particular teams who are hurt at the office or get a work-related illness giving the injured: Wage replacement advantages Medical treatment Trade rehabilitation Other benefits Various other certain teams are covered by: These entities serve the specific employee groups who are covered under the appropriate statutes and policies by reducing the financial problem resulting from work environment injury.

The Division of Labor has numerous programs made to protect against occupational injuries and health problems. You might get info regarding these programs by visiting our Work environment Safety and Health page.

Workers' settlement, also referred to as "workers' compensation," provides advantages to workers who end up being injured or unwell on the work due to a work-related crash. Workers' comp covers medical expenses, medical care benefits, earnings for shed wages, instructional re-training, and disability pay. Workers' settlement is a state government-mandated program, but the needed advantages vary from one state to another.

Accidents At Work Claims Wilmington, CA

Federal employees' compensation programs also exist, covering federal and power employees, in addition to longshore and harbor employees. One more government program, the Black Lung Program, handles death and handicap advantages for coal miners and their dependents. Employers can not call for employees to pay for the price of workers' payment. Needs for workers' settlement differ from state to state, and some states do not cover all staff members.

, whether partial or complete disability. Workers' settlement advantages are not generally taxed at the state or government degree, compensating for much of the lost revenue.

Attorneys For Workers Compensation Wilmington, CA

For instance, a building and construction employee could assert payment for an injury suffered in a loss from scaffolding yet except an injury incurred while driving to the job website. In other circumstances, employees can get the equivalent of sick pay while on clinical leave. If a worker dies due to a work-related occurrence, the employee's dependents get the workers' settlement settlements.

This giving in helps protect both the employees and companies. Workers surrender even more option for guaranteed settlement, while employers grant a degree of obligation while avoiding the possibly greater cost of a negligence legal action. An employer might challenge an employees' payment case since disagreements can develop over whether the company is liable for an injury or illness.

Attorney For Workers Comp Wilmington, CA

Employees' payment repayments are prone to insurance policy fraud. An employee might incorrectly report that their injury was endured on the job, overemphasize the extent of an injury, or create an injury. The National Insurance Criminal offense Board insists that there are "organized criminal conspiracy theories of crooked doctors, lawyers, and individuals" who submit false claims to medical insurance policy companies for employees' settlement and various other benefits.

That was just one of the bottom lines of contention in the dispute over a The golden state tally measure that sought to extend staff member benefits to chauffeurs for ride-sharing applications like Uber and Lyft. Like the supposed gig economic situation, the issue of employees' payment and other advantages for contract employees isn't going away given that gig workers have actually enhanced from 2012 to 2021 by virtually 5 million and represent 3% of the workforce.

In the U.S., private states manage workers' payment regulations. Still, it is accountable just for covering government staff members, longshoremen and harbor employees, energy employees, and coal miners. The absence of federal standards for workers' settlement has resulted in extremely varied policies for the same kinds of injuries from state to state.

Work Injury Attorney Wilmington, CA

Low-wage and immigrant employees often don't also use for benefits. There are two types of workers' payment protection: Protection A and Insurance Coverage B.

Simply put, there is no payroll reduction like there is with Social Safety and security benefits. The company has to pay workers' settlement benefits as developed by specific state laws. The price of employees' settlement insurance coverage averages $45 each month however varies by state, as do the mandated advantages. There likewise are various prices relying on whether the employees covered are performing low-risk or risky work.

Workmens Comp Lawyer Wilmington, CA

If your case is denied, you can appeal the choice with your state's Employees' Settlement Board. Typically, only workers are qualified for workers' settlement; service providers and freelancers are not. Beyond that, every state creates its own rules. For example, Arkansas particularly excludes ranch workers and property agents from qualification.

Louisiana omits artists and crop-dusting aircraft staff members. Every state (except Texas) calls for companies to provide workers' payment protection to at the very least some of their workers. The states compose the rules, so there are lots of exemptions and exemptions. Specialists and freelancers are rarely covered, and many states leave out certain professions from the mandate or otherwise limit the scope of the advantages.

Lawyer For Workmans Comp Wilmington, CA

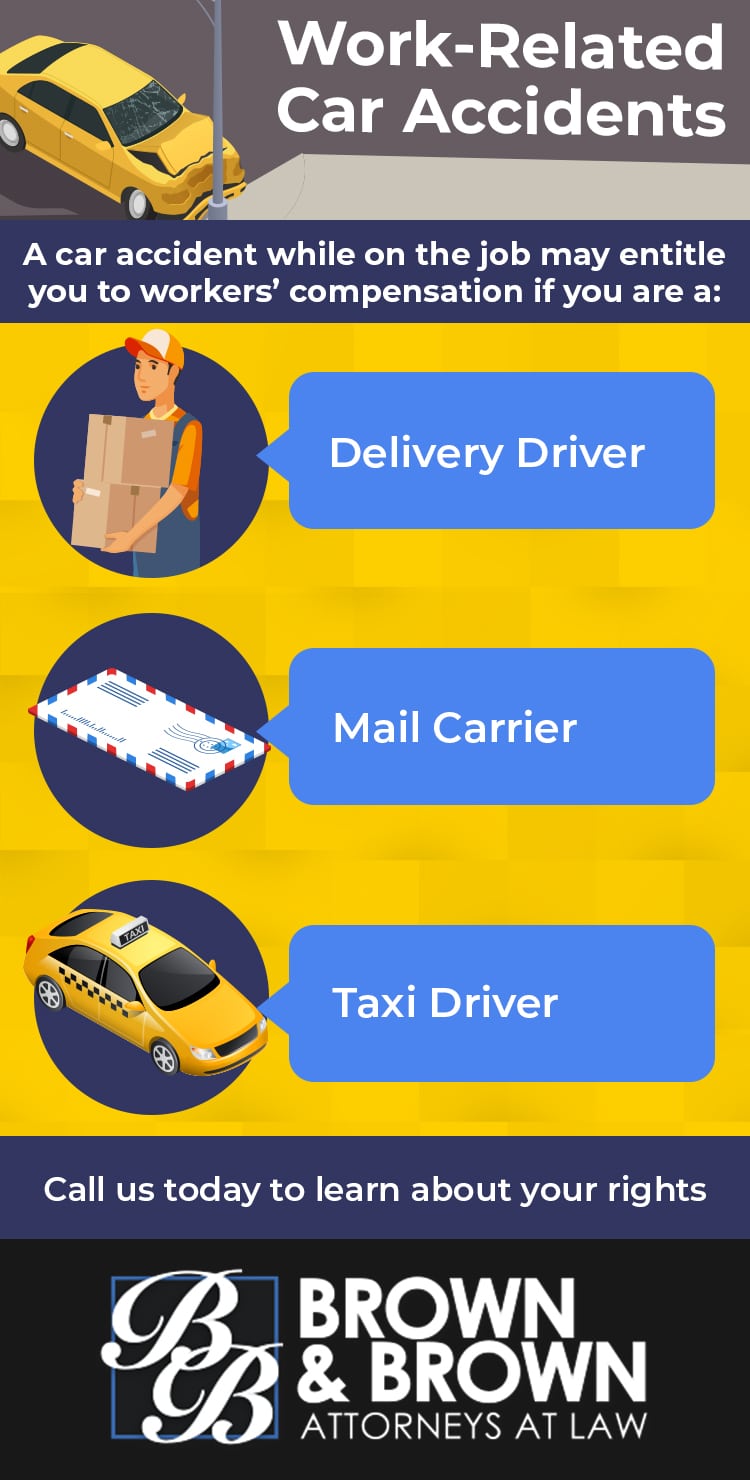

Last upgraded on June 17, 2024 According to Illinois regulation, employers must compensate injured workers for occupational injuries. Wilmington Los Angeles Workers Compensation Law Firms. Workers may be hurt by office equipment or succumb hazards posed by their duties. Automobile accidents on the work remain a leading reason of workplace injuries and casualties.

This system of laws is designed to secure and make up workers who are damaged while acting within the scope of their employment. Benefits offered under the Illinois Employees' Compensation Act consist of healthcare, special needs settlements, and fatality advantages. Relying on the extent of the employee's injuries, they might be qualified to momentary total special needs benefits, long-term total disability benefits, or partial disability advantages.

Worker S Compensation Lawyers Wilmington, CA

A worker that was entailed in a cars and truck accident would certainly intend to show that they were acting in the training course and range of work at the time of the collision. Often times, an employer or its insurance service provider will certainly contest the connection between the injury and the occupational obligations - Wilmington Los Angeles Workers Compensation Law Firms. It is the worry of the employees' payment claimant to reveal that at the time of the automobile crash, they were involved in an occupational task

Employees' payment also covers workers who are in an accident while driving a business automobile. It is essential to keep in mind that employees' compensation is a no-fault system.

Work Labor Lawyer Wilmington, CA

Visionary Law Group

Address: 100 W Broadway Suite #3000 Long Beach, CA 90802Phone: (562) 549-5655

Visionary Law Group

Staff members that are devoting a criminal act at the time of the motor lorry collision will certainly not have the ability to safeguard benefits. An employer's employees' payment carrier will likely reject protection for prices connected with injuries received in a crash while devoting a crime. Another exception to insurance coverage exists for workers who are travelling to work but have not yet begun working.

Attorneys For Workers Compensation Wilmington, CAWork Injury Lawyers Wilmington, CA

Work Injury Attorneys Wilmington, CA

Attorney For Workers Comp Wilmington, CA

Work Injury Lawyers Wilmington, CA

Work Injury Attorneys Wilmington, CA

Attorney Workmans Compensation Wilmington, CA

Work Labor Lawyer Wilmington, CA

Workmens Comp Lawyer Wilmington, CA

Los Angeles Workers Compensation Law Firms Wilmington, CA

Attorney Work Compensation Wilmington, CA

Worker Injury Lawyer Wilmington, CA

Workmens Comp Lawyer Wilmington, CA

Work Labor Lawyer Wilmington, CA

Workman Compensation Attorneys Wilmington, CA

Los Angeles Workers Compensation Law Firms Wilmington, CA

Lawyer Workers Comp Wilmington, CA

How To Win A Workmans Comp Case Wilmington, CA

Workman Comp Lawyers Wilmington, CA

Lawyers Workers Comp Wilmington, CA

Workman Comp Lawyers Wilmington, CA

Workers Compensation Injury Lawyer Wilmington, CA

Workmens Comp Lawyer Wilmington, CA

Attorney Work Compensation Wilmington, CA

Lawyer Work Compensation Wilmington, CA

Accident Work Compensation Wilmington, CA

How To Win A Workmans Comp Case Wilmington, CA

Lawyer Workers Comp Wilmington, CA

Workman Compensation Attorneys Wilmington, CA

Attorney Workmans Compensation Wilmington, CA

Lawyer Work Compensation Wilmington, CA

Worker Injury Lawyer Wilmington, CA

Work Injury Attorney Wilmington, CA

Attorney Workmans Comp Wilmington, CA

Lawyers Workers Comp Wilmington, CA

Attorney Workmans Comp Wilmington, CA

Workmens Comp Lawyer Wilmington, CA

Accident Work Compensation Wilmington, CA

Worker S Comp Lawyers Wilmington, CA

Workmens Comp Lawyer Wilmington, CA

Lawyer Workers Comp Wilmington, CA

Lawyer Work Compensation Wilmington, CA

Work Related Accident Lawyers Wilmington, CA

Work Injury Attorney Wilmington, CA

Work Labor Lawyer Wilmington, CA

Worker S Comp Lawyers Wilmington, CA

Attorney Workmans Comp Wilmington, CA

Workers Compensation Injury Lawyer Wilmington, CA

Worker S Compensation Lawyers Wilmington, CA

Attorney Work Compensation Wilmington, CA

Work Related Accident Lawyers Wilmington, CA

Workmens Comp Lawyer Wilmington, CA

Work Injury Attorney Wilmington, CA

Lawyer Workmans Compensation Wilmington, CA

Work Injury Attorney Wilmington, CA

Lawyer Work Compensation Wilmington, CA

Workmens Comp Lawyer Wilmington, CA

Attorneys For Workers Compensation Wilmington, CA

Workman Comp Lawyers Wilmington, CA

Worker S Compensation Lawyers Wilmington, CA

Worker S Comp Lawyers Wilmington, CA

Attorneys For Workers Compensation Wilmington, CA

How To Win A Workmans Comp Case Wilmington, CA

Accidents At Work Claims Wilmington, CA

Work Injury Attorney Wilmington, CA

Worker S Comp Lawyers Wilmington, CA

Workman Compensation Attorneys Wilmington, CA

Lawyers For Workers Comp Wilmington, CA

Attorney Workmans Comp Wilmington, CA

Lawyer Work Compensation Wilmington, CA

Lawyers For Workers Comp Wilmington, CA

Work Injury Attorney Wilmington, CA

Attorney For Workers Comp Wilmington, CA

Workmens Comp Lawyers Wilmington, CA

Work Related Accident Lawyers Wilmington, CA

Work Labor Lawyer Wilmington, CA

Attorney For Workers Comp Wilmington, CA

Near Seo Wilmington, CA

Near Seo Package Wilmington, CA

Visionary Law Group

Table of Contents

- – Work Related Accident Lawyers Wilmington, CA

- – Visionary Law Group

- – Accidents At Work Claims Wilmington, CA

- – Attorneys For Workers Compensation Wilmington, CA

- – Attorney For Workers Comp Wilmington, CA

- – Work Injury Attorney Wilmington, CA

- – Workmens Comp Lawyer Wilmington, CA

- – Lawyer For Workmans Comp Wilmington, CA

- – Worker S Compensation Lawyers Wilmington, CA

- – Work Labor Lawyer Wilmington, CA

- – Visionary Law Group

Latest Posts

Accident Lawyer Auto Studio City

Accident Auto Lawyer Pasadena

Newhall Accident Auto Lawyer

More

Latest Posts

Accident Lawyer Auto Studio City

Accident Auto Lawyer Pasadena

Newhall Accident Auto Lawyer